Nebius Group: Stock Price, AI Hype, and What's Actually Driving the Valuation

Is Nebius Group's AI Hyperscaling a Bubble Ready to Burst?

Nebius Group (NBIS) has been the darling of the AI hyperscaling world this year, with its stock price more than tripling. A 211% year-to-date increase is nothing to sneeze at, especially when compared to… well, pretty much everything else in the market. But let's pump the brakes for a second and actually look at the numbers, shall we? Because sometimes, the story behind the surge isn't quite as rosy as the headlines suggest.

The Hype vs. the Reality

The core narrative is compelling: massive demand for AI cloud infrastructure, fueled by hyperscalers like Meta and Microsoft. Nebius, with its AI-first data centers, is supposedly perfectly positioned to capitalize. We hear about huge contracts – $17.4 billion from Microsoft, $3 billion from Meta. It's all very exciting. But here's where my analyst's spidey-sense starts tingling.

Let's break down that Microsoft contract. $17.4 billion is the potential value, and the revenue isn't expected to start flowing until 2026. That's a long time to wait in the tech world (practically an eternity). And what happens if Microsoft decides to shift its strategy? Contracts aren't guarantees. It's a commitment, but based on my experience, that commitment is only as good as the fine print.

Then there's the Meta deal. Nebius claims the contract size was "limited to the amount of capacity that we had available." Translation: they could have gotten more money, but didn't have the resources. That's not exactly a sign of strength, is it? It suggests they're operating at their limit, and future growth hinges on massive, and potentially risky, infrastructure expansion.

The company is expected to end 2025 with 220 megawatts (MW) of connected data center power capacity. By the end of 2026, Nebius expects that capacity to land between 800 MW and 1 GW. That's a massive ramp-up, requiring significant capital expenditure. And this is the part of the report that I find genuinely puzzling. Where is that capital coming from? The reports don't explicitly address the funding mechanisms for this aggressive expansion.

A Deeper Dive into the Numbers

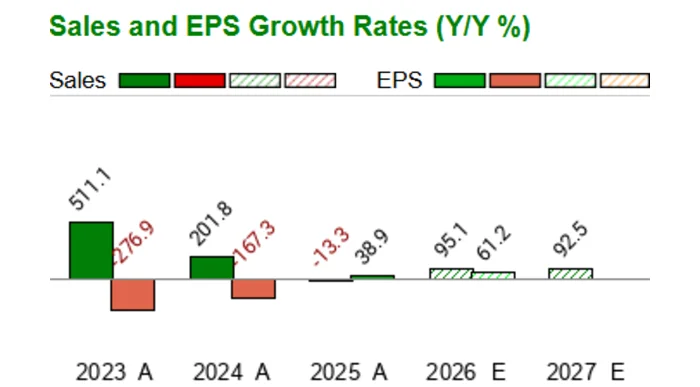

The rosy picture gets even more complicated when you look at Nebius' valuation. The stock is trading at a whopping 54 times sales. Even with projected revenue growth, that's a hefty premium. Now, the argument is that their growth rate and order backlog justify this valuation. But what if that growth slows down? What if those contracts don't materialize as expected? The downside risk is considerable.

One analyst estimates that if Nebius trades at 9 times sales and achieves $4.34 billion in revenue in 2027, its market cap could jump to just over $39 billion. That would be a 64% increase from current levels. But that's a lot of "ifs." And even with that growth, a 64% increase over two years, while solid, doesn't exactly scream "millionaire-maker."

And then there's the recent dip. Nebius Group (NASDAQ:NBIS) traded down 11% recently, bottoming out at $84.21. Volume was up 130% from average. Now, one down day doesn't make a trend, but it's a reminder that even the hottest stocks are vulnerable to market corrections and investor sentiment shifts. Nebius Group (NASDAQ:NBIS) Trading Down 11% - Should You Sell?

I've looked at hundreds of these filings, and the reliance on forward projections, without a clear explanation of how those projections will be met, is a red flag.

Is the Rocket About to Run Out of Fuel?

While the AI hyperscaling market undoubtedly has massive potential, Nebius' current valuation seems to be pricing in near-perfect execution and sustained hypergrowth. The company's aggressive expansion plans, reliance on a few key contracts, and a lack of clarity on funding raise some serious questions. I'm not saying Nebius is a bad company, but the current hype seems divorced from the underlying financial realities.

A Reality Check

The AI sector is exciting, but Nebius's numbers need to catch up to the narrative.

Related Articles

Fifth Third Swallows Comerica for $10.9B: Why It's Happening and Why You Should Care

So, another Monday, another multi-billion dollar deal that promises to "create value" and "drive syn...

PGE's Landmark Solar Investment: What It Means for Europe's Green Future

Why a Small Polish Solar Project is a Glimpse of Our Real Energy Future You probably scrolled right...

APLD Stock: AI Data Center Debt vs. Reddit's Take

Applied Digital's $2.35B Debt: Genius Move or a High-Stakes Gamble? The AI Data Center Debt Binge: A...

Julie Andrews: Why Her Legacy Endures Beyond Her Iconic Voice

I spend my days analyzing systems. I look at code, at networks, at AI, searching for the elegant des...

Fed's Latest Minutes: What the Data Reveals About Rate Cuts and Internal Disagreement

The Federal Open Market Committee just released the minutes from its September meeting, and if you w...

The 10-Year Treasury Yield: Why It's the Real Thing Screwing With Your Mortgage, Not the Fed

So You Think the Fed Controls Your Mortgage Rate? Think Again. Let me guess. You saw the headlines i...