APLD Stock: AI Data Center Debt vs. Reddit's Take

Applied Digital's $2.35B Debt: Genius Move or a High-Stakes Gamble?

The AI Data Center Debt Binge: APLD's Big Bet

Applied Digital (APLD) is making waves, no doubt. The company is trading around $23 these days, but the real story isn’t the daily price swings. It’s the sheer volume of debt they’re taking on to fuel their AI data center ambitions. A cool $2.35 billion in senior secured notes due 2030, to be exact, at a hefty 9.25% interest rate. That's on top of existing debt and preferred equity. Is this a stroke of genius, or are they playing with fire?

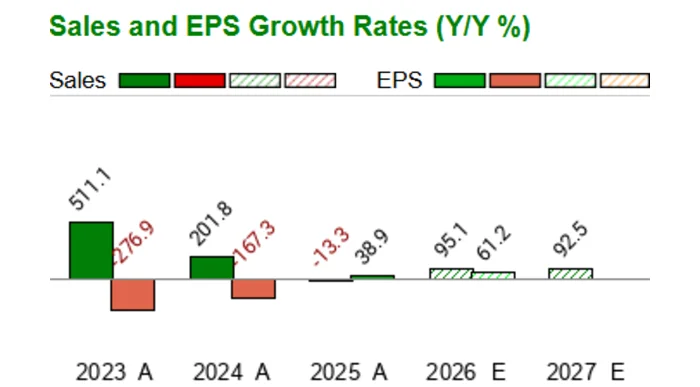

The bullish narrative is compelling: lock in long-term AI demand, hypergrowth potential (revenue up 84% year-over-year), and thematic tailwinds from the AI boom. They've got multi-year leases with CoreWeave and a major hyperscaler, supposedly leading to billions in contracted revenue. But let's dissect that "billions" figure for a moment.

Polaris Forge 1, fully leased to CoreWeave, is projected to generate $11 billion in contracted lease revenue over 15 years. That sounds impressive, until you annualize it: roughly $733 million per year. Now, consider the capital expenditure required to build and maintain a 400 MW data center. Are those margins really as fat as the bulls claim? And what happens if CoreWeave (CRWV) hits a snag?

The recent S-8 filing – registering 15 million additional shares – is another data point to consider. StockTitan calls it "neutral," emphasizing it’s for employee compensation, not a capital raise. But let’s be real: it still dilutes existing shareholders. An extra 15 million shares floating around slightly decreases the value of existing investments. It reinforces the fact that APLD is relying on equity awards to attract talent in a competitive market, which isn't necessarily a bad thing, but it's a cost that needs to be factored in.

Then there's the options market. A TipRanks item noted "mixed options sentiment," and Fintel data showed a put/call ratio of 0.54, meaning nearly twice as many calls as puts outstanding. This typically signals bullish positioning. But the absence of extreme call-buying suggests traders are waiting to see how the financing plays out. It's guarded optimism, not outright euphoria.

The Leverage Question: Can APLD Outrun Its Debt?

Here's where the skepticism kicks in. Applied Digital’s fundamentals, while showing growth, also reveal thin profits and rising debt. For the quarter ended August 31, 2025, they reported $64.2 million in revenue but a net loss of $27.8 million ($-0.11 per share). Adjusted EBITDA was a mere $0.5 million.

The question isn’t just about revenue growth; it’s about profitability. Can they scale fast enough to outrun the massive interest payments on that $2.35 billion debt? S&P Global Ratings assigned them a ‘B+’ credit rating with a positive outlook, which is decent, but also acknowledges the "elevated leverage profile." That’s analyst-speak for "they’re walking a tightrope."

I've looked at hundreds of these filings, and it's the sheer scale of the debt that raises eyebrows. It’s not uncommon for companies to leverage themselves, especially in high-growth sectors. But APLD is betting big – really big – that their AI data centers will generate enough cash flow to service this debt and deliver returns to shareholders.

The Macquarie Asset Management deal is structured as "non-dilutive" preferred equity, which sounds great on paper. But it's still a claim on future cash flows, and it adds complexity to the capital structure. Are they over-engineering the financing to avoid dilution, potentially at the expense of long-term financial flexibility?

One widely shared analysis framed the financing wave across APLD and peers as a potential "debt bomb" for the AI data-center trade. That might be hyperbolic, but it’s a risk worth considering. If AI infrastructure demand softens, or funding conditions tighten, APLD could find itself in a very uncomfortable position.

A High-Wire Act With No Safety Net

APLD is holding steady around $23, sure, but that’s just the surface. Beneath it lies a complex web of debt, equity, and ambitious growth plans. The long-term AI data center opportunity is undoubtedly enormous, but APLD’s financing obligations are equally massive. The company expects the $2.35B notes deal to close around November 20, 2025. APLD Stock Today, November 19, 2025: Applied Digital Holds Near $23 as New S‑8 Filing Follows AI Data Center Debt Surge Any hiccup there could send the stock tumbling.

For traders, APLD offers volatility. For long-term investors, the question is simple: can they convert their lease pipeline into sustainable cash flows quickly enough to outrun their rising cost of capital and dilution risk? My analysis suggests that the risk is skewed to the downside.

Too Much Debt, Too Little Margin for Error

Related Articles

Applied Digital's Earnings Report: What to Expect and What It Signals for the Future of AI

Yesterday, for a few dizzying minutes after the market closed, it looked like the story might be a s...