USPS Last-Mile Delivery: The Paradigm Shift Redefining How Your World Arrives

The USPS's Last Mile Gamble: A Revenue Play on a Crumbling Foundation

Postmaster General David Steiner has a vision for the U.S. Postal Service: "open up the last mile."Postal Service plans to ‘open up the last mile’ for more shippers - Supply Chain Dive It’s a bold declaration, announced on November 14, 2025, signaling a pivot from the previous administration's network focus to an aggressive pursuit of revenue growth. The idea is simple enough: leverage USPS's unparalleled reach—delivery to every single U.S. address, six days a week—to become a dominant player in everything from expanded last-mile services for giants like UPS (talks for Ground Saver are ongoing, with a preliminary agreement reached by October 29, 2025) to same-day and next-day delivery for retailers, and even becoming the nation's "most convenient returns facilitator." Steiner's message is clear: the agency can’t "cost cut its way to prosperity." It has to innovate, monetize, and grow.

On paper, the strategy makes a certain kind of sense. The USPS possesses a physical infrastructure, over 33,000 first-mile facilities, that FedEx and UPS can only dream of. It’s a competitive advantage, a golden goose, if you will, just waiting to lay golden eggs for a financially ailing agency. But here’s where my analysis diverges from the official narrative: a crucial, quantifiable data point is being, if not ignored, then certainly downplayed to a dangerous degree. While the PMG talks about opening the last mile, public trust in that very last mile is, quite frankly, evaporating faster than a puddle in the Mojave sun.

The Grand Vision, The Grimmer Reality

Steiner's plan is an ambitious reorientation. Under former leader Louis DeJoy, the strategy leaned towards optimizing the full network, sometimes shaking up partnerships. Now, Steiner wants to incentivize drop-offs closer to delivery, reversing a policy that previously limited access to USPS assets to only a few high-volume customers. This shift is designed to unlock significant new revenue streams, and I can see the logic in wanting to turn an underutilized asset into a profit center. After all, retailers do want fast, reliable, and affordable delivery. The demand side is undeniably strong.

However, the supply side, or rather, the security side, is in absolute disarray. While the USPS positions itself as the ultimate last-mile solution, the public is increasingly wary of entrusting their mail to it. We’re not talking about minor inconveniences here. Police departments are actively warning residents against using blue collection boxes. Customers report having checks washed, identities stolen, and entire savings accounts drained. Businesses are abandoning mail for payments, and the U.S. Treasury, a historically conservative entity, is even phasing out paper checks. The USPS itself, in a rather telling admission, advises avoiding mailing letters on Sundays and holidays due to system vulnerabilities. These aren't just anecdotes; they're data points reflecting a systemic breakdown in confidence.

The Data Doesn't Lie: A Self-Inflicted Wound

Now, let's talk about the numbers that truly underscore this crisis. Since August 2020, mail theft has exploded more than twentyfold in major metro areas. To be more exact, some regions have seen increases well over 2,000%. Thousands of "arrow keys"—those master keys that open collection boxes and apartment panels—are openly sold on the dark web. Carrier robberies are at historic highs. And what happened in August 2020? The USPS abruptly restricted its own Postal Police Force (PPOs) to postal property, effectively eliminating their proactive, uniformed crime prevention role in the "last mile" itself. PPOs, let's remember, are uniformed federal law-enforcement officers specifically tasked with patrolling mail-theft hot spots and protecting carriers and high-risk deliveries.

I've reviewed these types of operational shifts before, and the immediate, quantifiable fallout here is genuinely stark. The correlation between sidelining the PPOs and the explosion in mail crime isn't just strong; it's practically a causal link. Frank Albergo, President of the Postal Police Officers Association (PPOA), put it bluntly, and my analysis of the crime statistics supports him: the last mile cannot become a growth engine without restoring public trust and protecting it with PPOs. It’s like trying to launch a new luxury cruise line while the docks are infested with pirates. You might have the fanciest ship, but no one's going to board if they're worried about getting robbed before they even leave the pier.

My analysis suggests that the current strategy is built on a fundamental contradiction. How can the USPS expect to "better utilize and monetize" its first-mile and last-mile capabilities when the very integrity of those miles is under constant assault? Arrests and convictions for mail theft have collapsed, and even oversight bodies report the Postal Inspection Service misallocates resources. The agency's key competitive advantage—its ubiquitous physical presence—becomes its greatest vulnerability when it's not adequately secured. What’s the ROI on a delivery service if the package never makes it, or worse, if the act of sending it exposes customers to identity theft? This isn't just about lost revenue; it's about the erosion of a foundational public service.

A Strategy on Shaky Ground

PMG Steiner’s vision for a revenue-driven USPS is commendable in its ambition. He wants to compete, to innovate, and to keep the Postal Service relevant in a rapidly changing delivery landscape. He stands against privatization, which is a stance many can appreciate. But the data on postal crime, the direct consequences of the 2020 PPO policy shift, paint a picture of an agency trying to build a new skyscraper on a foundation riddled with cracks. Without a concrete, quantifiable plan to restore security and public trust in the "last mile"Last-Mile Delivery Does Not Work If No One Trusts It - FEDweek—a plan that, to my mind, must involve re-empowering the Postal Police—this bold new revenue strategy looks more like a high-stakes gamble with deeply unfavorable odds. The desire for growth is understandable, but ignoring the gaping hole in the bucket means you'll just be pouring money into the ground.

Related Articles

IRS Direct Deposit Stimulus: The Truth About the October 2025 Payment

That $2,000 IRS Stimulus Check? It's Not Real, But The Rumor Itself Is Telling Let’s be clear, becau...

Analyzing 2025's Investment Landscape: What the Data Reveals About Top Asset Classes vs. Low-Risk Alternatives

There's a quiet, pervasive myth circulating among the baby boomer generation as they navigate retire...

United CEO Scott Kirby: What's his angle on Verizon layoffs and CDC vaccines

Scott Kirby's Two-Airline Prophecy: Data-Driven Dominance or Just High-Altitude Hype? Scott Kirby, U...

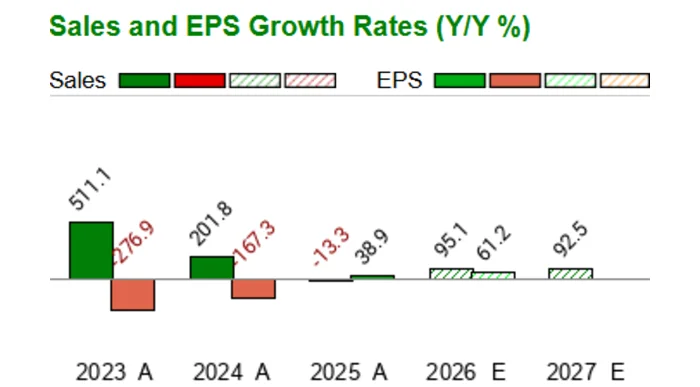

Nvidia's Earnings: AI Bubble Fears Ease – The Future is Here

The AI Bubble? More Like the Big Bang Okay, folks, buckle up. Because what we're seeing with Nvidia...

Gold Price Analysis: Today's Price, Key Metrics, and the Silver Correlation

Gold's Dizzying Climb to $4,000: A Sober Look at the Numbers Behind the Hype The numbers flashing ac...

APLD Stock: AI Data Center Debt vs. Reddit's Take

Applied Digital's $2.35B Debt: Genius Move or a High-Stakes Gamble? The AI Data Center Debt Binge: A...